how to purchase tax liens in alabama

Tax lien certificates not sold at the county level can be purchased from the Alabama State Commissioner of Revenue Sec. After holding costs like property management fees property taxes insurance and maintenance reserves you net 800 a month.

Amazon Com How To Buy State Tax Lien Properties In Alabama Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Alabama Ebook Mahoney Brian Kindle Store

You can purchase tax lien properties the same way that you can purchase and sell properties at an auction.

. For tax liens the lien can also be filed in the taxpayers county of residence. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. To report a criminal tax violation.

On the Alabama Department of. There are more than 51469 tax liens currently on the market. The tax lien properties seem appealing to investors since you have the opportunity.

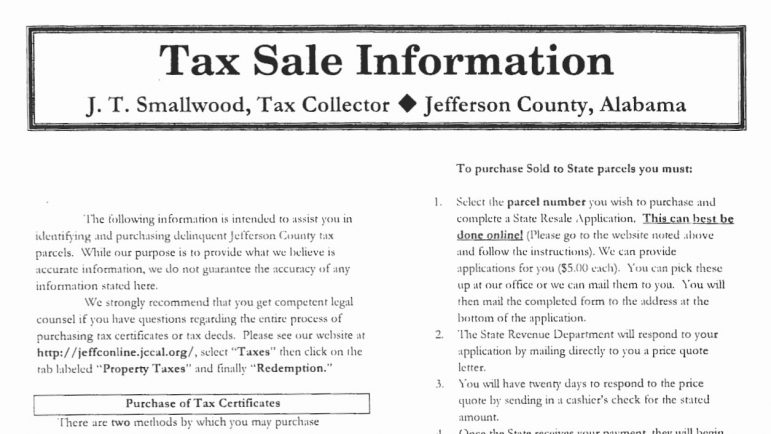

Alabama taxes must be paid on October 1 and are due on January 1. Compared to working with real estate agents and mortgage loan officers buying tax delinquent properties is refreshingly quick and simple. 40-10-21 and 40-10-132 Alabama Department of Revenue.

On the Alabama Department of Revenue website you can browse the tax delinquent property listings available in your county. However I lost the title. In exchange they get the right to collect that money back plus money in interest and fines.

Your total investment in the property is around. When investors buy the liens at auction they pay the full amount of taxes owed. Upon registration investors will be given a bidder number which will be used during the tax lien auction.

When you find one that interests you. Buying tax liens at auctions direct or at other sales can turn out to be awesome. Search all the latest Alabama tax liens available.

According to Alabama Code 40-10-191 the holder of a tax lien certificate shall have the first right to purchase the tax lien relating to a subsequent delinquency on the property described in. If you do not pay your property taxes in Alabama you will be liable for liens on your home. If the creditor wants to establish a security interest in someones personal property because of a transaction also.

Alabama currently has 88445 tax liens available as of October 29. With tax lien certificates purchasers are investing their money with Jefferson County Alabama and when the Jefferson County Alabama Tax Collector collects the past due taxes they send. Tax liens are purchased with a 3 year redemption period and a 12 percent annual rate.

I satisfied on the lien on my vehicle and received the Alabama certificate of title with the lien released on the certificate of title.

Alabama Tax Sale Module 4 Youtube

Faq Alabama Tax Sale Investing Youtube

When Do I Own Property I Purchase At An Alabama Tax Sale Williams Associates

Madison County Sales Tax Department Madison County Al

Tax Lien Properties Alabama Birmingham Al

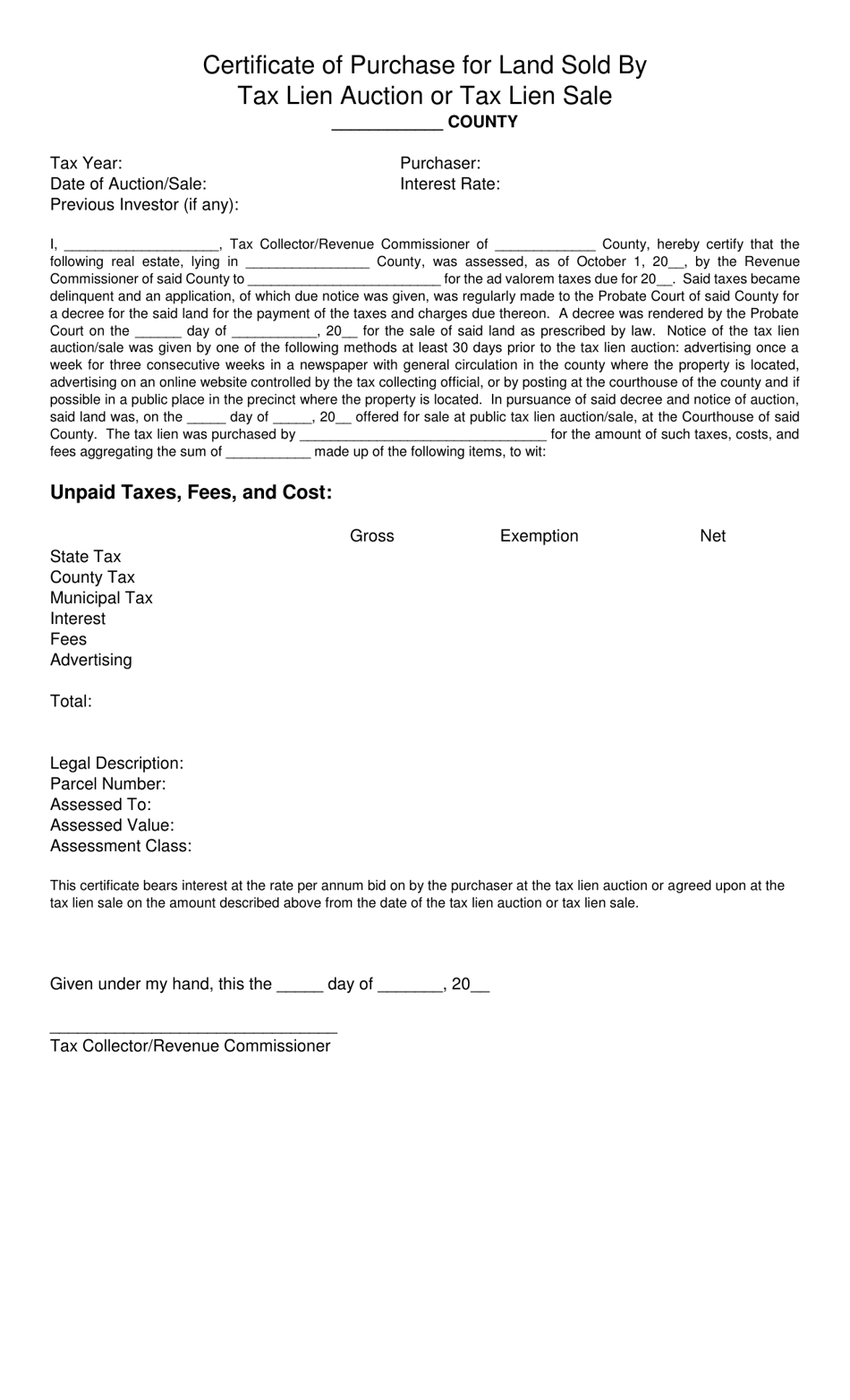

Alabama Certificate Of Purchase For Land Sold By Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

Here S Why You Could Have Property Tax Liens In Your Portfolio

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Alabama Tax Delinquent Property Home Facebook

City Of Selma Announces Annual Tax Sale On June 24 News Selmasun Com

Is Alabama A Tax Lien Or Tax Deed State

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Alabama Sales Tax Holiday Begins This Month The Troy Messenger The Troy Messenger

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

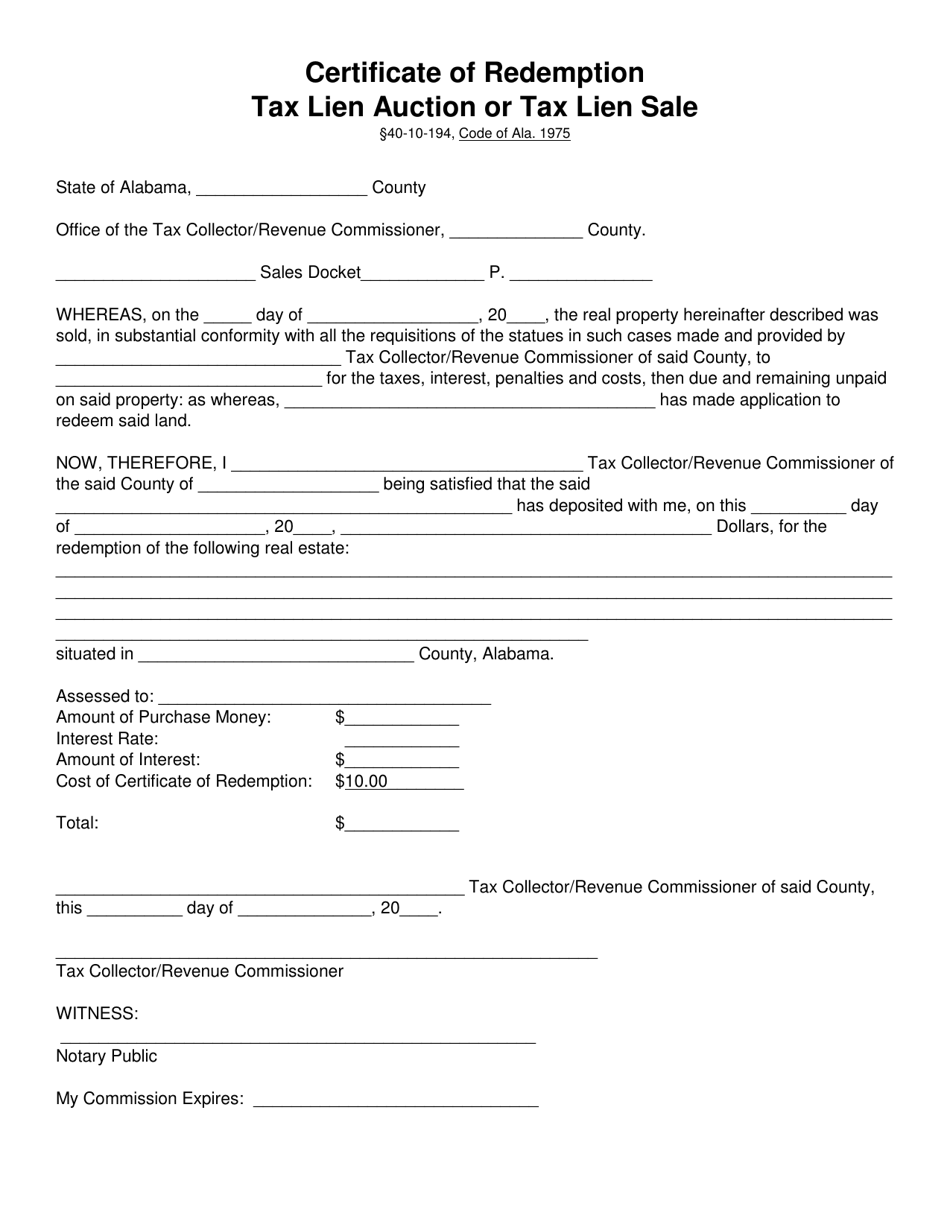

Alabama Certificate Of Redemption Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

We Answered 9 Questions About Alabama S Tax Free Weekend July 17 19 Bham Now