new mexico gross receipts tax exemptions

Francis Drive Santa Fe NM. To be exempt from.

Economy Of New Mexico Wikipedia

However deductions exemptions and credits may apply.

. As a seller or lessor you may charge the gross receipts tax amount to your customer. New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. However the Federal Government is only exempt from specific types of transactions in New Mexico.

On April 4 2019 New Mexico Gov. Compensating tax exemption applies to all 501c3. Box 630 Santa Fe New Mexico 87504-0630 GROSS RECEIPTS COMPENSATING TAXES.

School Event Services Exemption Receipts from refereeing umpiring scoring or other officiating at school events sanctioned by the New Mexico Activities Association 7-9-414. Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the innocent spouse tax relief application process. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that.

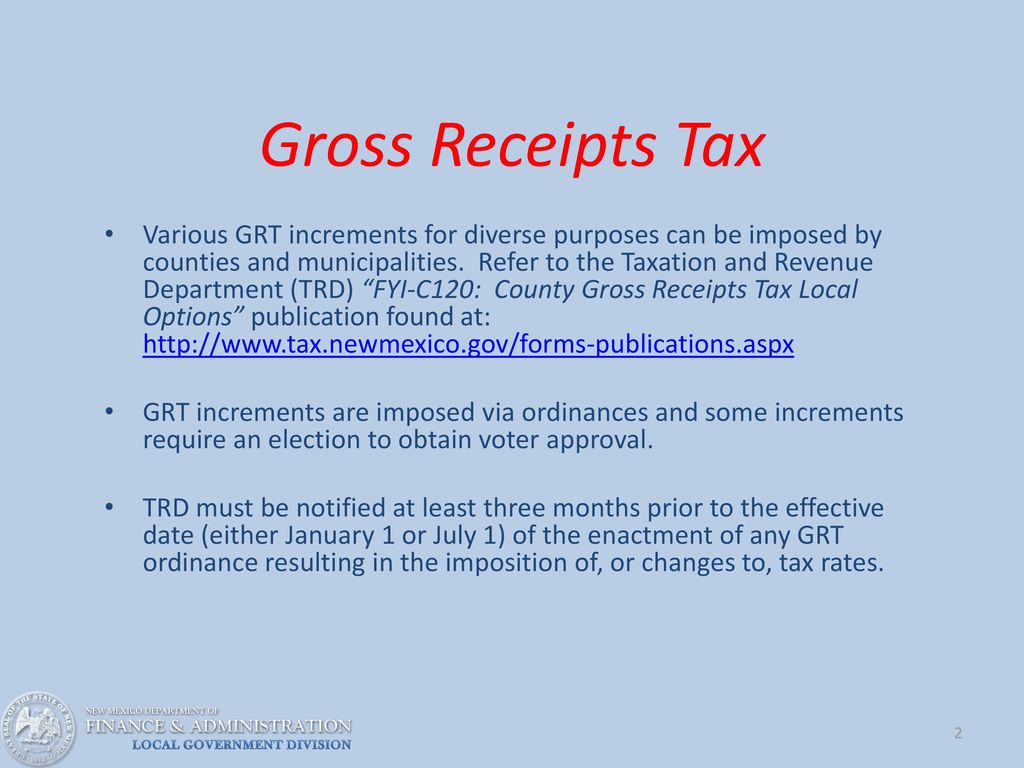

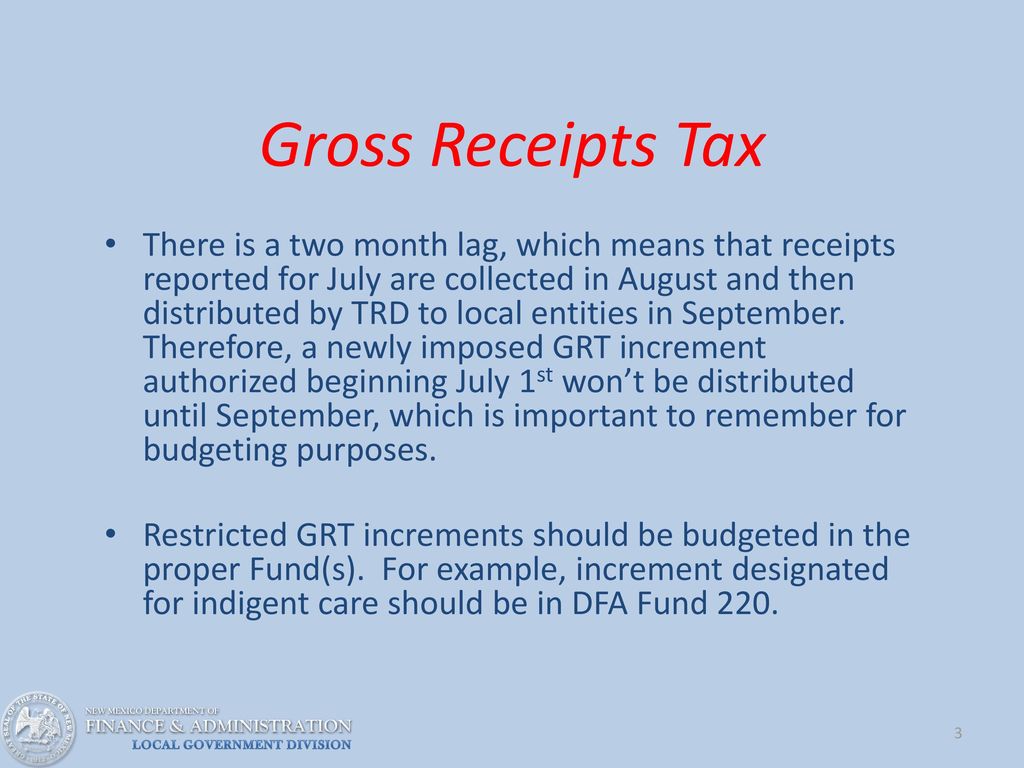

BOR 76-1 Regulations in Effect and Pertaining to the New Mexico Gross Receipts and Compensating Tax Act 72676 filed 72676. No forms are required. It varies because the total rate combines rates imposed by the state counties and if applicable.

New Mexico Economic Development Department Joseph M. Imposition and rate of tax. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375.

For example centrally billed accounts are not. This measure adds sunset dates to a number of gross receipts tax GRT and compensating tax CT deductions including the following. An exempt receipt is not taxable and.

Section 7-9-131 - Exemption. Tax InformationPolicy Office PO. Default position is that receipts from all services are subject to gross receipts tax.

For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is. New Mexico imposes gross receipts tax on all services. Consumables Gross Receipts Tax Deduction for Manufacturers.

New Mexico views 501c3 nonprofit organiza-tions as engaging in business. The same goes for. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

There are over 40 exemptions listed in New Mexico law. Hearing scheduled April 29 on new. Denomination as gross receipts tax.

DOH may be exempt from gross receipts tax. Services performed outside the state the product of which is initially used in New Mexico. AN OVERVIEW JULY 1 2020 - JUNE 30 2021.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. The exemptions the state grants are for property tax income tax and gross receipts tax. It varies because the total rate combines rates.

The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. Legal liability for New Mexico gross receipts tax is placed on sellers and lessors. They apply to the gross receipts of specific organizations or under defined circumstances.

Laboratory partnership with small business tax credit may be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to. RD79-1 Gross Receipts and Compensating. The GRT deduction for the receipts from selling wind generation equipment or solar generation equipment to a government for the purpose of installing a wind or solar electric generation.

House Bill 184256 2012 amended Section 7-9-46 NMSA 1978 to expand the gross receipts deduction for sales of tangible property to manufacturers to include property consumed in the process of manufacturing excluding tools and equipment. Section 7-9-29 NMSA 1978. Section 7-9-131 - Exemption.

Montoya Building 1100 S. The GRT deduction for the receipts from selling wind.

New Mexico Income Tax Calculator Smartasset

What Is Gross Receipts Tax Overview States With Grt More

New Mexico August 2014 Sales Tax Holiday Avalara

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Gross Receipts And Property Tax Ppt Download

New Mexico Proposes Digital Advertising Services Gross Receipts Tax Regs

General Sales Taxes And Gross Receipts Taxes Urban Institute

Nm Gross Receipts Tax Deduction For Food And Beverage

New Mexico State Income Taxes Calculator Community Tax

Gross Receipts And Property Tax Ppt Download

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

A Guide To New Mexico S Tax System New Mexico Voices For Children

Here Are The 10 Most Unusual Exemptions To Nm S Gross Receipts Tax Albuquerque Business First

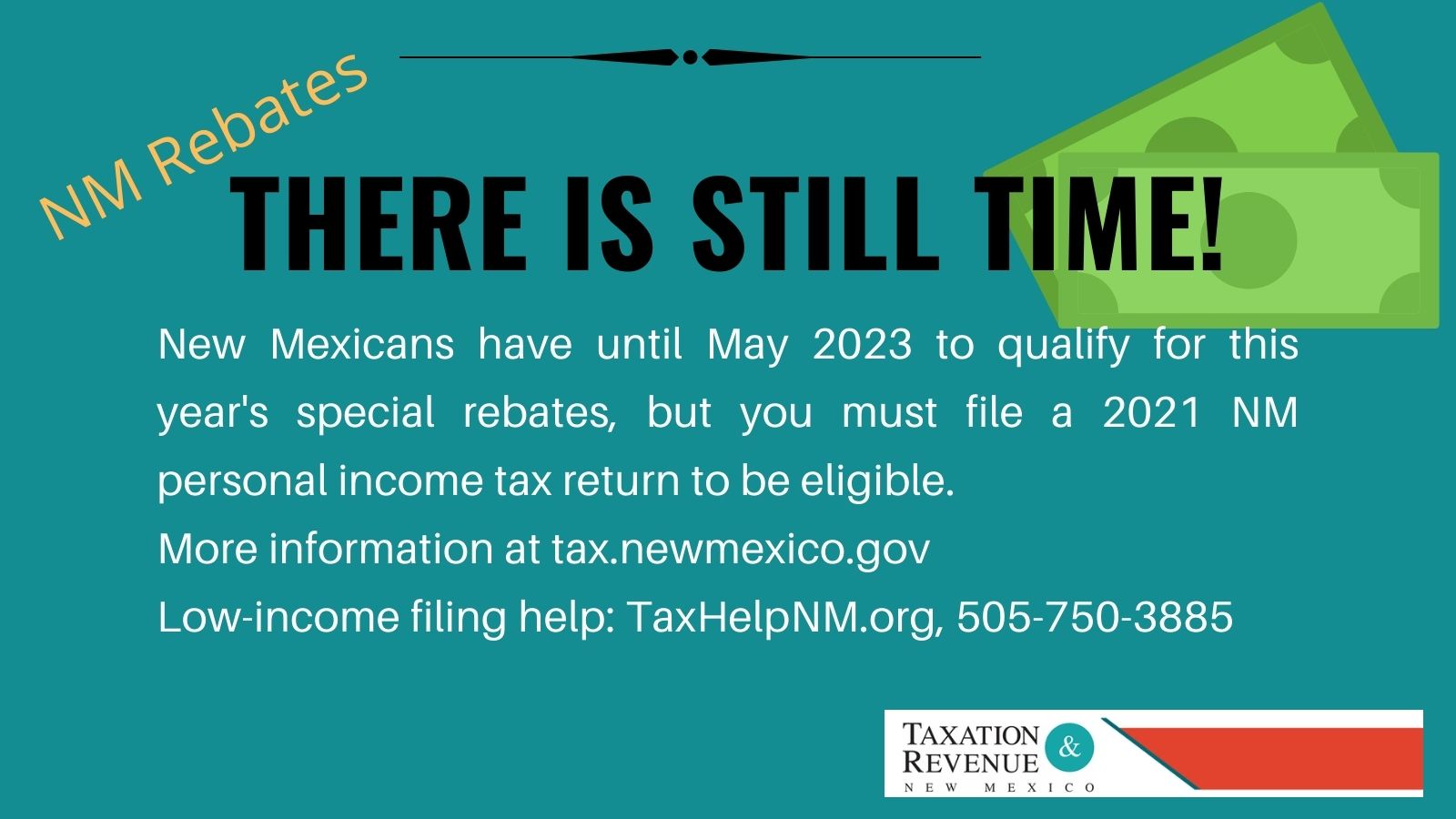

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)